Impinj Reports Second Quarter 2020 Financial Results

Impinj released its financial results for the second quarter ended June 30, 2020.

Seattle, WA July 29, 2020 - Impinj, Inc. (NASDAQ: PI), a leading provider and pioneer of RAIN RFID solutions, today released its financial results for the second quarter ended June 30, 2020.

“Covid-19 negatively impacted our second-quarter results, and the continuing uncertainty tempers our third-quarter outlook,” said Chris Diorio, Impinj co-founder and CEO. “Regardless, we see brightness ahead. Endpoint IC bookings are improving, large systems opportunities are accelerating and, longer term, we see adoption accelerating as leading end users leverage the improved visibility, insights, virtualization and customer experience that RAIN brings to their businesses.”

Second Quarter 2020 Financial Summary

- Revenue of $26.5 million

- GAAP gross margin of 49.0%; non-GAAP gross margin of 51.4%

- GAAP net loss of $17.5 million, or loss of $0.77 per diluted share using 22.7 million shares

- Adjusted EBITDA loss of $5.2 million

- Non-GAAP net loss of $5.6 million, or loss of $0.25 per diluted share using 22.7 million shares

A reconciliation between GAAP and non-GAAP information is contained in the tables below. Additionally, descriptions of these non-GAAP financial measures are provided in the “Non-GAAP Financial Measures” sections below.

Third Quarter 2020 Financial Considerations

Impinj is continuing to monitor the impact of Covid-19 on its business, including how Covid-19 will affect customers, end users, suppliers and other business partners. However, given the uncertainty regarding the duration and severity of the epidemiological, economic and operational impacts of Covid-19, as of the date of this report Impinj cannot reasonably estimate the pandemic’s impact on its operating results for third-quarter 2020 or future periods.

For additional information regarding the impact of Covid-19 on our business, operating results, financial condition and prospects, please see Impinj’s Quarterly Report on Form 10-Q expected to be filed on the date hereof.

Proposed Settlement of Stockholder and Securities Class Action Lawsuits

Securities Class Action Lawsuits

On July 9, 2020, following a private settlement mediation with lead plaintiff in the federal securities class actions and plaintiff in the New York State securities class action discussed below, the parties in both actions executed a stipulation of settlement that resolves the claims asserted in both actions. The proposed settlement provides for a payment to the plaintiff class of $20.0 million. Our insurers will contribute approximately $14.6 million to the settlement, and we will contribute the remaining settlement amount of approximately $5.4 million. Accordingly, we recorded a provision of $5.4 million related to our estimated settlement amount to general and administrative expenses for the three and six months ended June 30, 2020. The proposed settlement is subject to preliminary and, following notice to class members, final approval by the United States District Court for the Western District of Washington.

Shareholder Derivative Actions

On July 10, 2020, following a private settlement mediation, the parties in this action executed a stipulation of settlement to settle and resolve the claims asserted in this consolidated derivative action. The proposed settlement requires us to implement certain corporate governance changes and the payment of up to $900,000 to plaintiffs’ counsel for attorneys’ fees and expenses. Our insurers will contribute the entire amount paid for attorneys’ fees and expenses. The proposed settlement is subject to preliminary and, following notice to shareholders, final approval by the United States District Court for the District of Delaware. On July 15, 2020, the court entered an order requesting that the parties file supplemental briefing in respect of their joint motion for preliminary approval of the settlement. These supplemental briefs are due August 5, 2020.

Conference Call Information

Impinj will host a conference call today, July 29, 2020 at 5:00 p.m. ET / 2:00 p.m. PT for analysts and investors to ask questions on its second quarter 2020 results. Open to the public, investors may access the call by dialing +1-412-317-5196. A live webcast of the conference call will also be accessible on our website at investor.impinj.com. Following the webcast, an archived version will be available on the website for one year. A telephonic replay of the call will be available one hour after the call and will run for five business days and may be accessed by dialing +1-412-317-0088 and entering passcode 10145777.

Management’s prepared written remarks, along with quarterly financial data, will be made available on our website at investor.impinj.com commensurate with this release.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding the market for RAIN RFID, bookings, systems deployments, our strategy, prospects, the impact of Covid-19, and financial considerations for third-quarter 2020 and future periods. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption "Risk Factors" and elsewhere in our annual report on Form 10-K and quarterly reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. All information provided in this release and in the attachments is as of the date hereof, and we undertake no duty to update this information unless required by law.

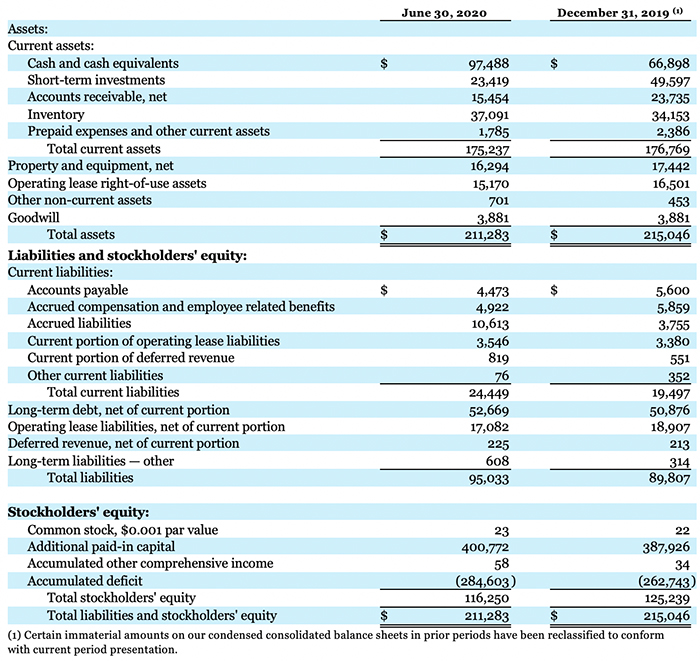

IMPINJ, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value, unaudited)

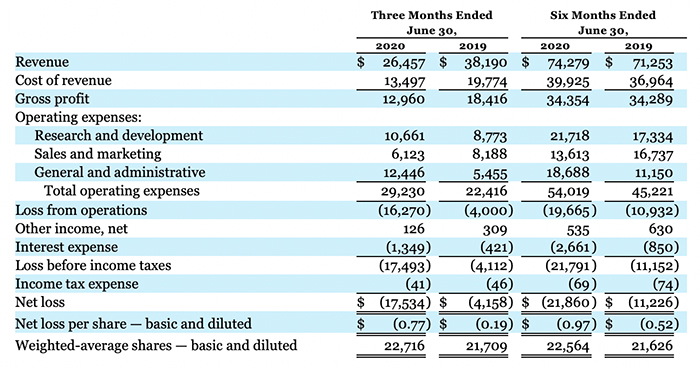

IMPINJ, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data, unaudited)

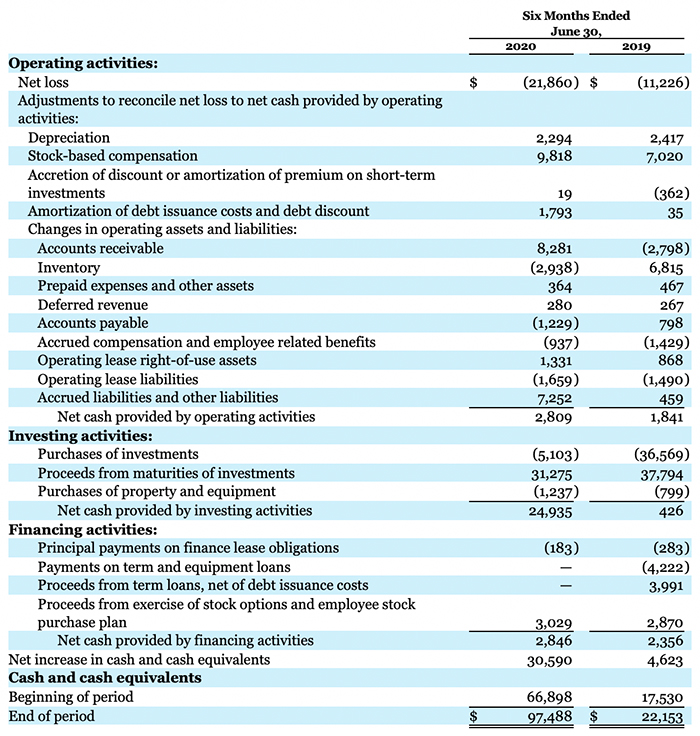

IMPINJ, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

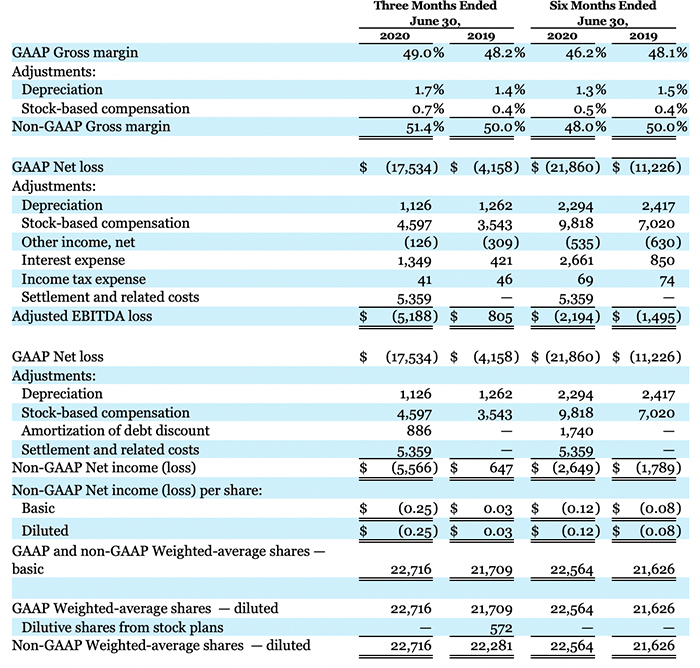

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements prepared and presented in accordance with U.S. generally accepted accounting principles, or GAAP, our key non-GAAP performance measures include adjusted EBITDA and non-GAAP net income (loss), as defined below. We use adjusted EBITDA and non-GAAP net income (loss) as key measures to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operating plans. We believe these measures provides useful information for period-to-period comparisons of our business to allow investors and others to understand and evaluate our operating results in the same manner as it does for our management and board of directors. Our presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from similarly termed non-GAAP measures used by other companies.

Adjusted EBITDA

We define adjusted EBITDA differently in this release than we have previously, by excluding proposed litigation settlements of class-action and derivative lawsuits including related costs, such as that we incurred in second-quarter 2020. Our consequent definition of adjusted EBITDA is net income (loss) determined in accordance with GAAP, excluding, if applicable for the periods presented, the effects of stock-based compensation; depreciation; investigation costs; restructuring costs; settlement and related costs; other income, net; interest expense; loss on debt extinguishment; and income tax benefit (expense). We have excluded settlement and related costs because we do not believe they reflect our core operations and us excluding them enables more consistent evaluation of our operating performances. Excluding the settlement and related costs does not impact adjusted EBITDA previously reported for prior periods.

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) differently in this release than we have previously, by excluding proposed litigation settlements of class-action and derivative lawsuits including related costs, such as that we incurred in second-quarter 2020. Our consequent definition of non-GAAP net income (loss) is net income (loss) determined in accordance with GAAP, excluding, if applicable for the periods presented, the effects of stock-based compensation; depreciation; investigation costs; restructuring costs; settlement and related costs; amortization of debt discount related to the equity component of our convertible notes; and prepayment penalty on debt extinguishment. We have revised the prior period non-GAAP net income (loss) to conform to our current period presentation. Excluding settlement and related costs did not impact non-GAAP net income previously reported for prior periods.

GAAP requires that certain convertible debt instruments that may be settled in cash on conversion be accounted for as separate liability and equity components in a manner that reflects our non-convertible debt borrowing rate. This accounting results in the debt component being treated as though it was issued at a discount, with the debt discount being amortized as additional non-cash interest expense over the debt instrument term using the effective interest method. As a result, we believe that excluding this non-cash interest expense attributable to the debt discount in calculating our non-GAAP net income (loss) is useful because this interest expense is not indicative of our ongoing operational performance.

IMPINJ, INC. RECONCILIATIONS OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

(in thousands, except percentages, unaudited)

Wednesday, July 29, 2020

About Impinj

Impinj (NASDAQ: PI) helps businesses and people analyze, optimize, and innovate by wirelessly connecting billions of everyday things—such as apparel, automobile parts, luggage, and shipments—to the Internet. The Impinj platform uses RAIN RFID to deliver timely data about these everyday things to business and consumer applications, enabling a boundless Internet of Things. www.impinj.com

Investor Relations Contact

Investor Relations

+1-206-315-4470

[email protected]

Media Contact

Jill West

Vice President, Strategic Communications

Phone: +1 206-834-1110

[email protected]

Learn more about Impinj

Impinj Investor Relations

Find investor information. Impinj is publicly traded (NASDAQ: PI).

Go to investor website