Impinj Reports First Quarter 2020 Financial Results

Impinj today released its financial results for the first quarter ended March 31, 2020.

Seattle, WA April 27, 2020 - Impinj, Inc. (NASDAQ: PI), a leading provider and pioneer of RAIN RFID solutions, today released its financial results for the first quarter ended March 31, 2020.

“Our first-quarter revenue was strong, setting another company record,” said Chris Diorio, Impinj co-founder and CEO. “Despite the prevailing sentiment in many of our end markets being negative, there are bright spots as well, such as in omnichannel retail and supply chain and logistics. Regardless, considering the significant uncertainties looking forward, we feel it is prudent to not give quantitative guidance for the second quarter.”

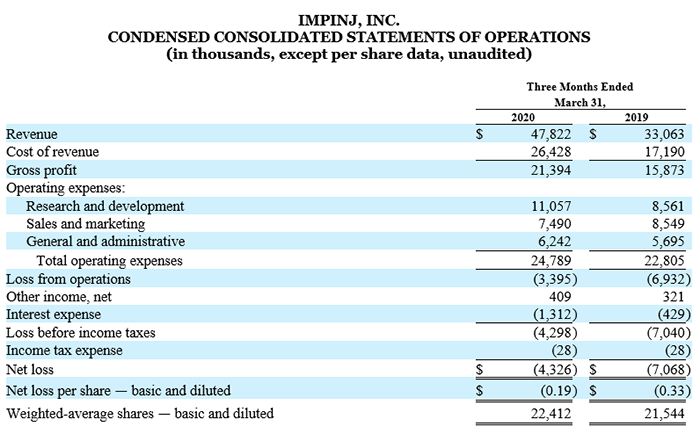

First Quarter 2020 Financial Summary

- Revenue of $47.8 million

- GAAP gross margin of 44.7%; non-GAAP gross margin of 46.1%

- GAAP net loss of $4.3 million, or loss of $0.19 per diluted share using 22.4 million shares

- Adjusted EBITDA of $3.0 million

- Non-GAAP net income of $2.9 million, or income of $0.13 per diluted share using 23.0 million shares

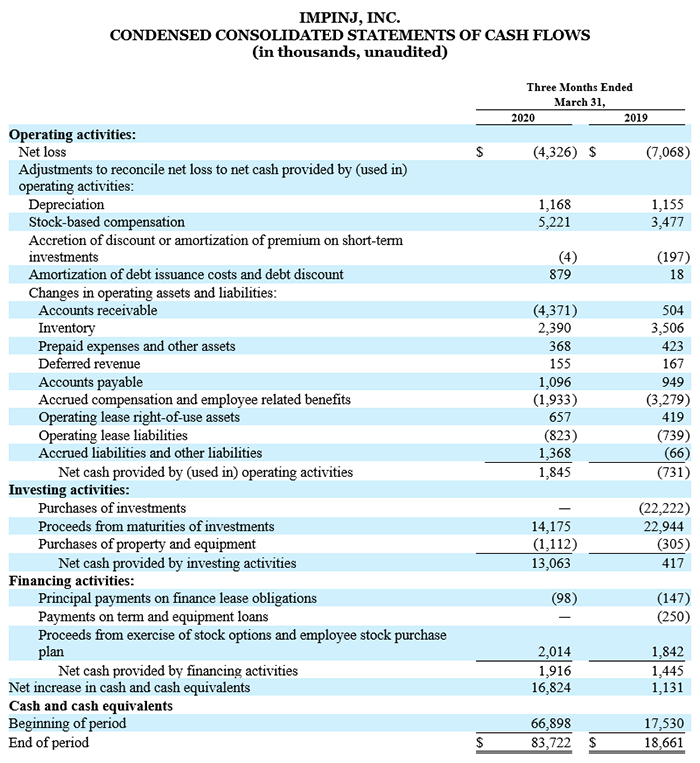

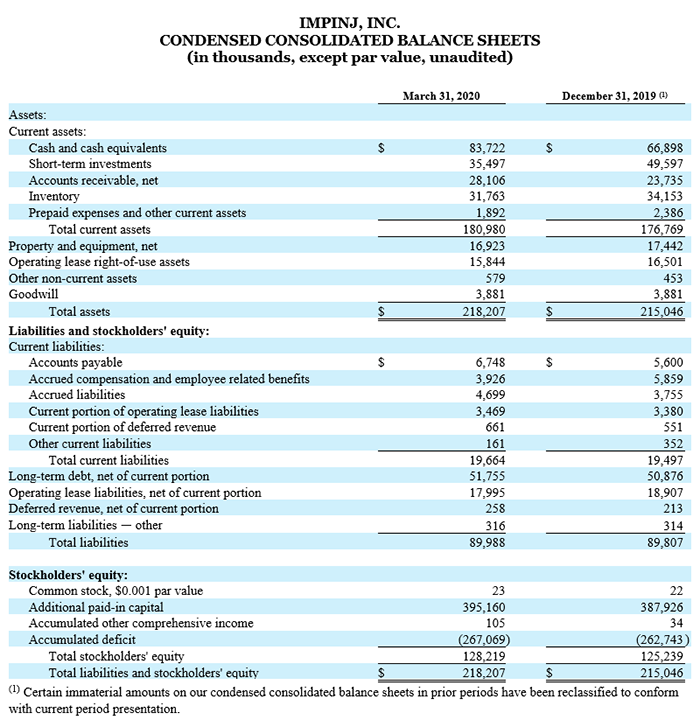

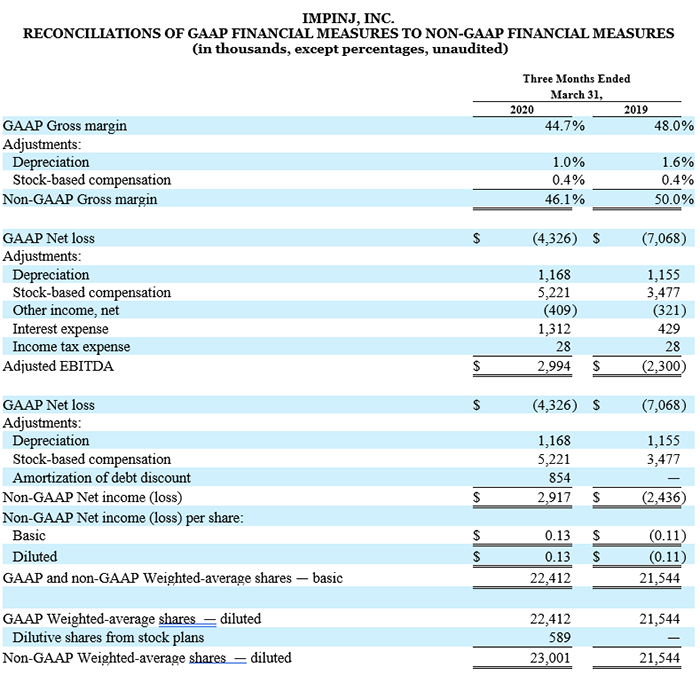

A reconciliation between GAAP and non-GAAP information is contained in the tables below. Additionally, descriptions of these non-GAAP financial measures are provided in the “Non-GAAP Financial Measures” sections below.

Second Quarter 2020 Financial Considerations

Impinj is continuing to monitor the impact of the Covid-19 pandemic on its business, including how the pandemic will affect customers, end-users, suppliers and other business partners. However, given the uncertainty regarding the duration and severity of the epidemiological, economic and operational impacts of Covid-19, as of the date of this report Impinj cannot reasonably estimate the pandemic’s impact on its operating results for the second quarter of 2020 or future periods.

For additional information regarding the impact of the Covid-19 pandemic’s impact on our business, operating results, financial condition and prospects, please see Impinj’s Quarterly Report on Form 10-Q expected to be filed on the date hereof.

Conference Call Information

Impinj will host a conference call today, Apr. 27, 2020 at 5:00 p.m. ET / 2:00 p.m. PT for analysts and investors to ask questions on its first quarter 2020 results. Open to the public, investors may access the call by dialing +1-412-317-5196. A live webcast of the conference call will also be accessible on our website at investor.impinj.com. Following the webcast, an archived version will be available on the website for one year. A telephonic replay of the call will be available one hour after the call and will run for five business days and may be accessed by dialing +1-412-317-0088 and entering passcode 10142298.

Management’s prepared written remarks, along with quarterly financial data, will be made available on our website at investor.impinj.com commensurate with this release.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding the market for RAIN RFID, our strategy, prospects, the impact of the Covid-19 pandemic, and financial considerations for the second quarter of 2020 and future periods. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption "Risk Factors" and elsewhere in our annual report on Form 10-K and quarterly reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. All information provided in this release and in the attachments is as of the date hereof, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements prepared and presented in accordance with U.S. generally accepted accounting principles, or GAAP, we use non-GAAP financial measures by financial statement line items that exclude, if applicable for the periods presented, the effects of stock-based compensation, depreciation, investigation costs, restructuring costs and other expenses that we believe do not reflect our core operating performance. Our key non-GAAP performance measures include adjusted EBITDA and non-GAAP net income (loss), the definitions of which are below. We use adjusted EBITDA and non-GAAP net income (loss) as key measures to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operating plans. We believe excluding those items can provide useful information for period-to-period comparisons of our business to allow investors and others to understand and evaluate our operating results in the same manner as it does for our management and board of directors. Our presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

Adjusted EBITDA

We define adjusted EBITDA as net income (loss) determined in accordance with GAAP, excluding, if applicable for the periods presented, the effects of stock-based compensation; depreciation; investigation costs; restructuring costs; other income, net; interest expense; loss on debt extinguishment and income tax benefit (expense).

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) as net income (loss) determined in accordance with GAAP, excluding, if applicable for the periods presented, the effects of stock-based compensation; depreciation; investigation costs; restructuring costs; amortization of debt discount related to the equity component of our senior convertible notes; and prepayment penalty on debt extinguishment. Under GAAP, certain convertible debt instruments that may be settled in cash on conversion are required to be accounted for as separate liability and equity components in a manner that reflects our non-convertible debt borrowing rate. This results in the debt component being treated as though it was issued at a discount, with the debt discount being amortized as additional non-cash interest expense over the term of the notes using the effective interest method. As a result, we believe that excluding this non-cash interest expense attributable to the debt discount in calculating our non-GAAP net income (loss) is useful because this interest expense is not indicative of our ongoing operational performance. We incurred prepayment penalty on debt extinguishment in connection with the December 2019 repayment of our senior credit facility, which was included in loss on debt extinguishment in our condensed consolidated statements of operations. Because of the non-recurring nature of the prepayment fees, we believe this expense is not representative of ongoing operation costs.

- Article tagged as:

Monday, April 27, 2020

About Impinj

Impinj (NASDAQ: PI) helps businesses and people analyze, optimize, and innovate by wirelessly connecting billions of everyday things—such as apparel, automobile parts, luggage, and shipments—to the Internet. The Impinj platform uses RAIN RFID to deliver timely data about these everyday things to business and consumer applications, enabling a boundless Internet of Things. www.impinj.com

Investor Relations Contact

Investor Relations

+1-206-315-4470

[email protected]

Media Contact

Jill West

Vice President, Strategic Communications

Phone: +1 206-834-1110

[email protected]

Learn more about Impinj

Impinj Investor Relations

Find investor information. Impinj is publicly traded (NASDAQ: PI).

Go to investor website