Impinj Reports Full Second Quarter 2018 Financial Results

Company completes independent investigation and files form 10Q.

Seattle, WA September 12, 2018 - Impinj Inc. (NASDAQ: PI), a leading provider and pioneer of RAIN RFID solutions for identifying, locating and authenticating everyday items, today released its full financial results for the quarter ended June 30, 2018. The Company also disclosed that the Audit Committee completed the independent investigation the Company announced in its August 2nd press release related to a complaint filed by a former employee. The Committee concluded there was no credible evidence supporting the former employee’s claims. The Company had delayed filing its second-quarter Form 10Q and announcing full second-quarter results pending completion of the investigation.

“Our second quarter 2018 results are consistent with our August 2nd press release,” said Chris Diorio, Impinj co-Founder and CEO. “We are pleased that the Audit Committee was able to complete its independent investigation, and are proud that the outcome reaffirms that we operate our business according to the highest ethical principles. We continue to see momentum building as our team focuses on executing our vision of identifying, locating and authenticating every item in our everyday world.”

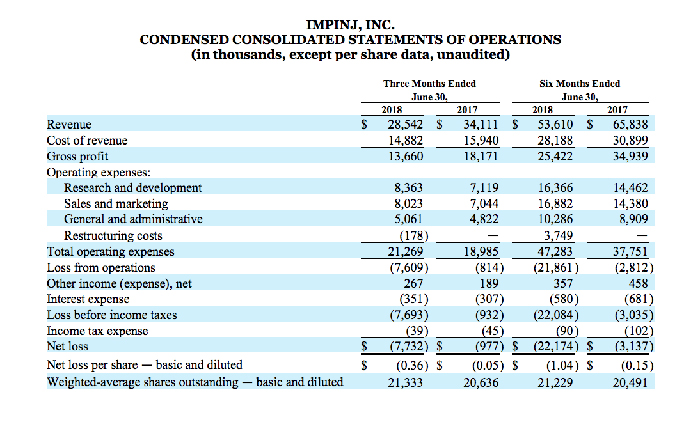

Second Quarter 2018 Financial Summary

- Revenue was $28.5 million

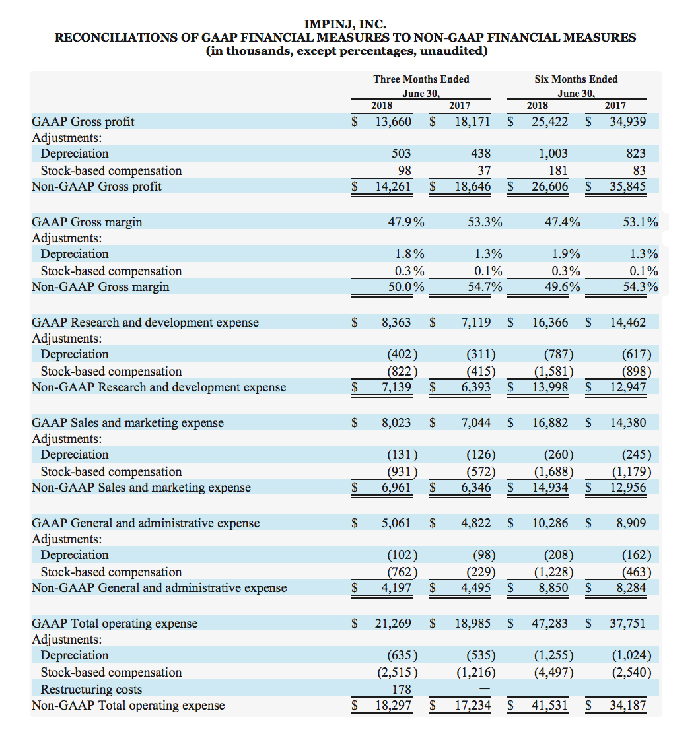

- GAAP gross margin of 47.9%; non-GAAP gross margin of 50.0%

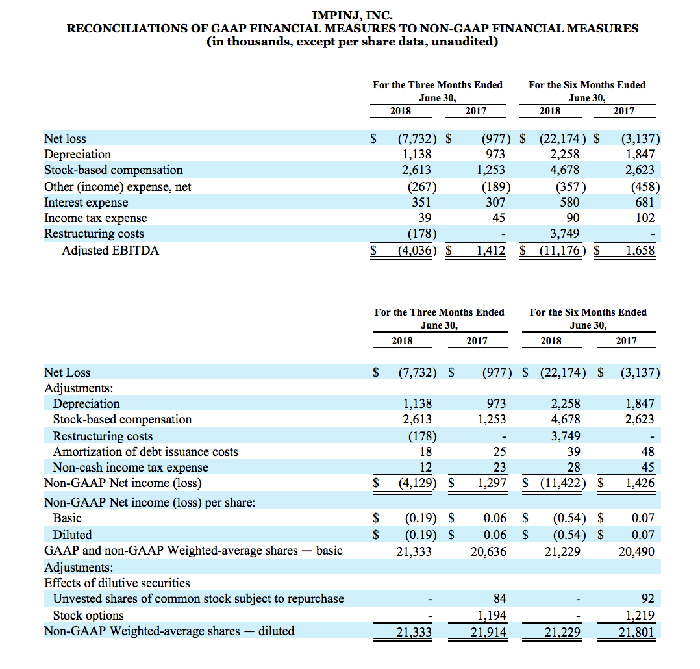

- GAAP net loss of $7.7 million, or loss of $0.36 per basic and diluted share using 21.3 million shares

- Adjusted EBITDA loss of $4.0 million

- Non-GAAP net loss of $4.1 million, or loss of $0.19 per diluted share using 21.3 million shares

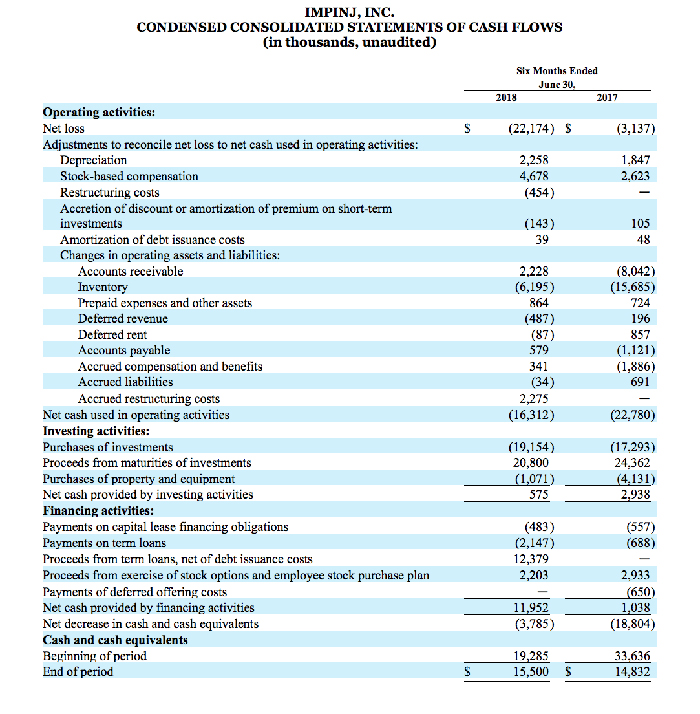

A reconciliation between GAAP and non-GAAP information, including weighted-average basic and diluted shares, is contained in the tables below. Additionally, descriptions of these non-GAAP financial measures are provided in the “Non-GAAP Financial Measures” sections below.

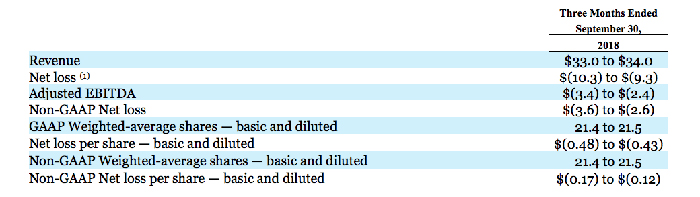

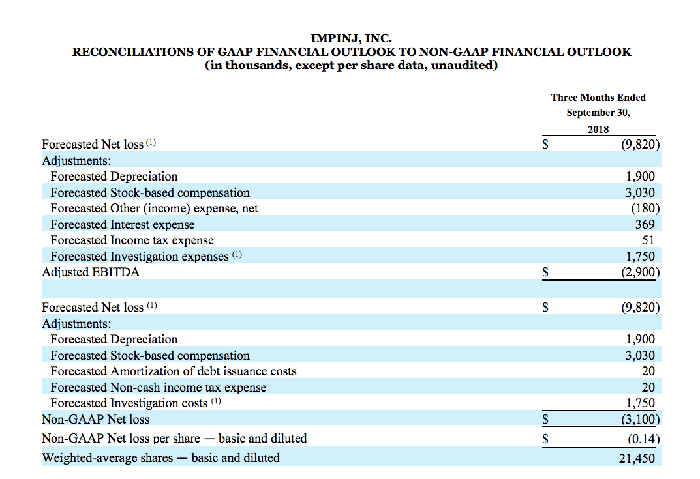

Third Quarter 2018 Financial Outlook

Impinj provides guidance based on current market conditions and expectations; actual results may differ materially. Please refer to the comments below regarding forward-looking statements. The following table presents Impinj’s financial outlook for the third quarter of 2018 (in millions, except per share data):

(1) The third quarter outlook for GAAP Net loss includes estimated expenses associated with the recently completed investigation. If actual investigation costs differ from our estimate, net loss may differ from the outlook provided.

A reconciliation between GAAP and non-GAAP is provided in the "Non-GAAP Financial Measures" section below.

Audit Committee Investigation Findings

The Audit Committee, assisted by independent counsel that the Committee retained to oversee a thorough and careful investigation, concluded that there was no credible evidence supporting the former employee’s complaint. Accordingly, the Audit Committee determined that no additional actions were necessary or warranted with respect to the complaint or the investigation, including that no adjustments to past financial statements were appropriate or required, and that, at this time, no further investigatory steps need to be taken. With the filing of the Company’s second-quarter Form 10Q today, the Company is in compliance with its SEC filing obligations.

Conference Call Information

Impinj will host a conference call tomorrow, September 13, 2018 at 8:00 a.m. ET / 5:00 a.m. PT for analysts and investors to ask questions on our second quarter 2018 results. Open to the public, investors may access the call by dialing +1-412-317-5196. A live webcast of the conference call will also be accessible on our website at investor.impinj.com. Following the webcast, an archived version will be available on the website for one year. A telephonic replay of the call will be available one hour after the call and will run for five business days and may be accessed by dialing +1-412-317-0088 and entering passcode 10121728.

Management’s prepared written remarks, along with quarterly financial data for the last eight quarters, will be made available on our website at investor.impinj.com commensurate with this release.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding the market for RAIN RFID, our strategy, prospects, and financial outlook for the third quarter of 2018. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the caption "Risk Factors" and elsewhere in our annual report on Form 10-K and quarterly reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. All information provided in this release and in the attachments is as of the date hereof, and we undertake no duty to update this information unless required by law.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements prepared and presented in accordance with U.S. generally accepted accounting principles, or GAAP, we use non-GAAP financial measures by financial statement line items that exclude the effects of stock-based compensation, depreciation, restructuring costs and other expenses that we believe do not reflect our core operating performance. Our key non-GAAP liquidity and performance measures include adjusted EBITDA and non-GAAP net income (loss), see definitions of such below. We use adjusted EBITDA and non-GAAP net income (loss) as key measures to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operating plans. We believe excluding those expenses inherent in calculating adjusted EBITDA and non-GAAP net income (loss) can provide useful measures for period-to-period comparisons of our business. Accordingly, we believe that adjusted EBITDA and non-GAAP net income (loss) provide useful information to investors and others in understanding and evaluating our operating results in the same manner as it does for our management and board of directors. Our presentation of these non-GAAP financial measures is not meant to be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP, and our non-GAAP measures may be different from non-GAAP measures used by other companies.

Adjusted EBITDA

We define adjusted EBITDA as net income (loss) determined in accordance with GAAP, excluding the effects of stock-based compensation, depreciation, restructuring costs, other income (expense), net, interest expense and income tax expense. Restructuring costs relate to an effort in the first quarter of 2018 to reduce headcount and sublease office space to match strategic and financial objectives and optimize resources for long term growth. We believe that adjusted EBITDA provides meaningful supplemental information regarding our performance and liquidity.

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) to consist of net income (loss) determined in accordance with GAAP, excluding the effects of stock-based compensation, depreciation, restructuring costs (for more information about restructuring costs, please refer to description in adjusted EBITDA above), amortization of debt issuance costs and non-cash income tax expense. We exclude the non-cash portion of income taxes because of our ability to offset a substantial portion of future income tax liabilities by utilizing our deferred tax assets, which primarily consist of federal net operating loss carryforwards and federal research and experimentation credit carryforwards. By better reflecting our future operating performance we believe this presentation will enhance comparability of our operating results.

(1) The third quarter outlook for GAAP Net loss includes estimated expenses associated with the recently completed investigation. If actual investigation costs differ from our estimate, net loss may differ from the outlook provided.

- Article tagged as:

Wednesday, September 12, 2018

About Impinj

Impinj (NASDAQ: PI) helps businesses and people analyze, optimize, and innovate by wirelessly connecting billions of everyday things—such as apparel, automobile parts, luggage, and shipments—to the Internet. The Impinj platform uses RAIN RFID to deliver timely data about these everyday things to business and consumer applications, enabling a boundless Internet of Things. www.impinj.com

Investor Relations Contact

Investor Relations

+1-206-315-4470

[email protected]

Media Contact

Jill West

Vice President, Strategic Communications

Phone: +1 206-834-1110

[email protected]

Learn more about Impinj

Impinj Investor Relations

Find investor information. Impinj is publicly traded (NASDAQ: PI).

Go to investor website